2,800+

APIs inside out

Powered by a layered API architecture, InsurerMate© delivers openness, modularity, automation and limitless scalability - ready to evolve with every wave of industry change.

By seamlessly blending system APIs into rich experience APIs, the platform transforms insurers and MGAs into agile technology leaders, capable of driving innovation across their entire ecosystem - faster than ever before.

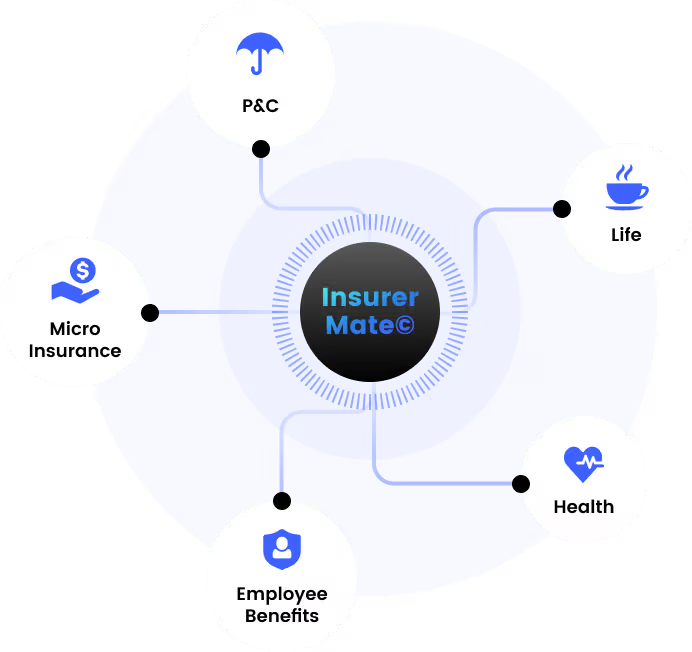

All products, each in its own way

- Comprehensive Product Coverage: Supports the full range of insurance products, including mainstream products p&c, health, life, employee benefits and their innovated variants of embedded micro insurance.

- Layered Product Structure: Creates rich offerings through a tiered architecture of shared components -> product packaging -> schemes white-labelling.

- Product-Specific Configuration: Enables 360 degree product-specific configuration from policy to claims to billing until reinsurance and accounting.

- Configurable Without Code: Product-specific variations are easily managed by business users through intuitive no-code/low-code tools.

End-to-end revolutionization

- End-to-End Lifecycle Support: Covers the full value chain from policy administration, billing, claims, reinsurance, to customer servicing.

- Fully Digital Experience: Delivers seamless, real-time digital engagement for customers, channels, partners and internal teams across all touchpoints.

- Straight-Through Processing (STP): Leverages automation to ensure seamless, touchless processing across core workflows, boosting speed and system efficiency.

- Real-Time Data and Insights: Provides instant access to data and analytics to support decision-making and customer personalization.

Where innovation takes off

InsurerMate© is purpose-built to empower insurers and MGAs to incubate, test, and scale innovations quickly and effectively.

- Product Innovation - The platform enables rapid design and deployment of non-traditional insurance products through flexible structuring and mix-and-match capabilities, such as stackable insurance, embedded microinsurance, insure-as-you-go, bundled offerings, insurance & non-insurance combinations, etc.

- Technology Innovation - Our API-driven architecture enables plug-and-play integration, ensuring rapid adoption of new technologies - whether from Bytesforce, our partners, or the broader technology market.

Unleash intelligence

through API + AI

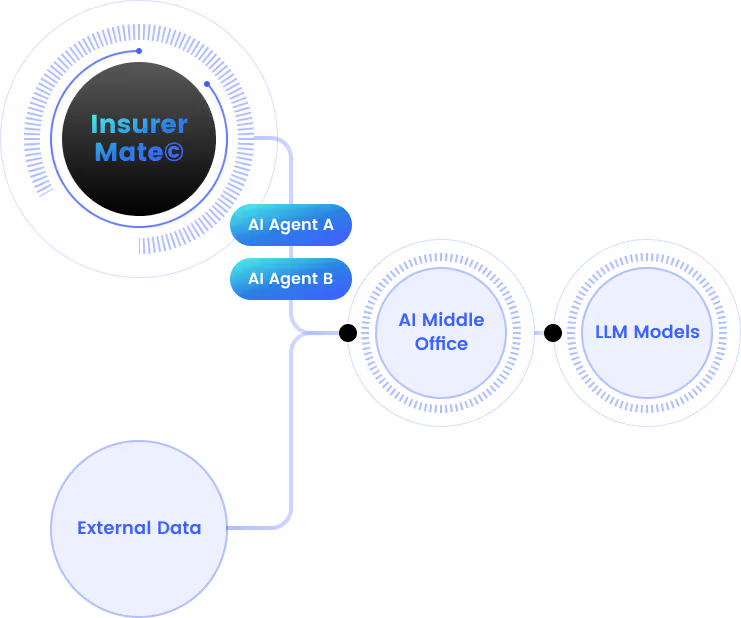

InsurerMate© is not only AI-ready - it's built to unlock the full potential of AI through native API + AI architecture.

- Scalably AI Middle Office - No-code / Low-code platform to orchestrate, manage, and scale AI Agents tailored to unlimited business tasks throughout the operation.

- API and AI - Easily plug AI agents anywhere to connect with InsurerMate© APIs, creating a seamless two-way feedback loop that continuously enhances intelligence.

Technical features

Multi-tenantedAll entities, all countries on one platform

Cloud-agnosticElastic, containerized, automated CI/CD across all cloud platforms

No-code / Low-codeUser-oriented configuration and built-in DSLs power nearly 100% of changes required

High performanceVertical and horizontal scalability, read-write separation and elastic search capabilities

High availability24/7 uptime, enabled by read-write separation, stateless services and grey deployments

High securityMulti-layered security with authentication, authorization and data protection

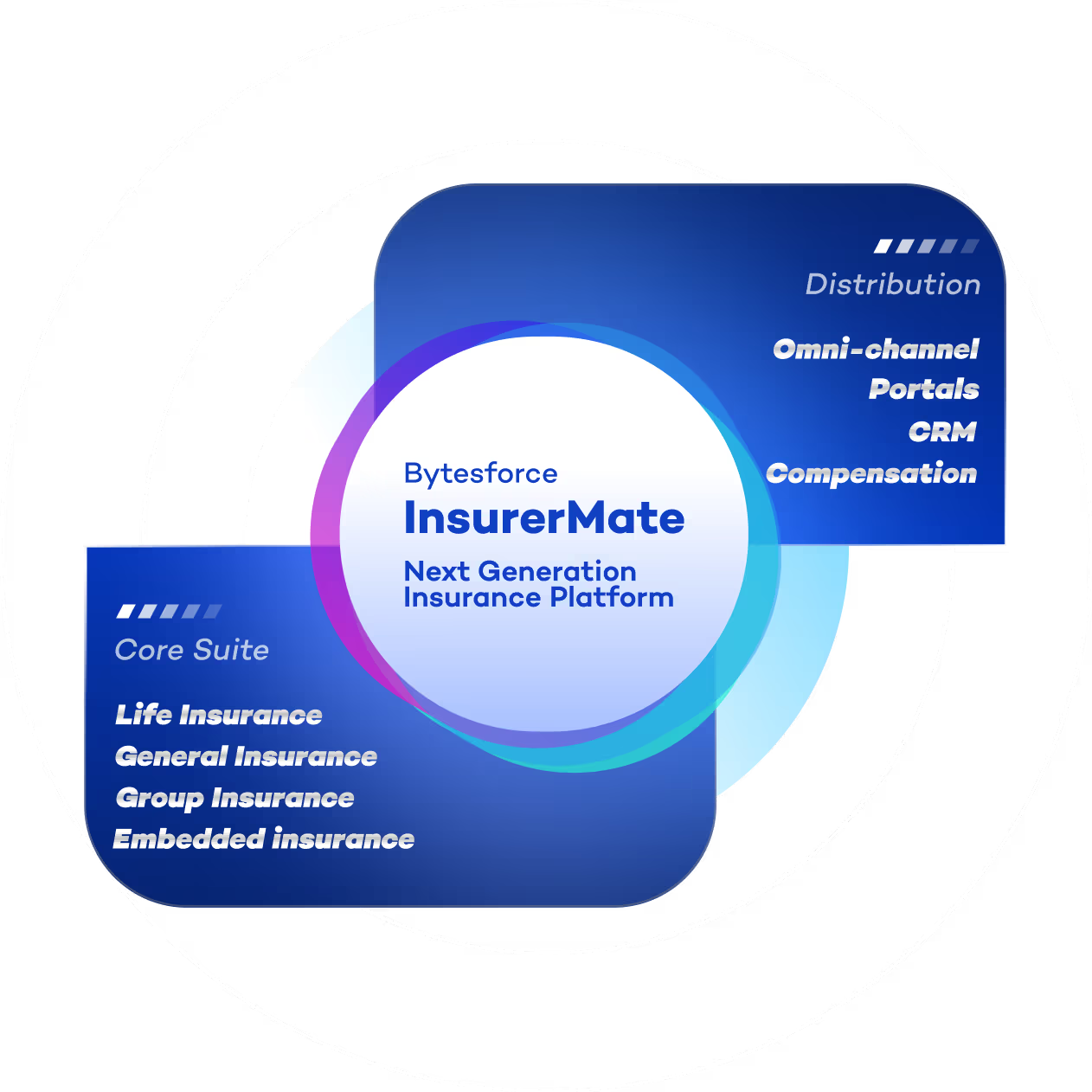

InsurerMate© drives all solutions we offer

P&C Core Suite

Fostering product innovation, intelligence, and end-to-end digitalization, we brings to life every imagination for the future of property & casualty insurance.

L&H Core Suite

The next generation of life & health core solution, built on the most advanced architectural principles and contemporary design language.

EB Core Suite

Complex made simple - powering group insurance for SMEs and large corporates alike, from ready-made packages to tailor-made offerings, with a digital-first EB Core Suite.

All-Lines Core Suite

For insurance groups operating across both Property & Casualty and Life & Health, the All-Lines Core Suite is the ideal choice.

Omni-channel Distribution

Configure once, distribute across all channels and engagement models.

Embedded Micro Insurance Core

Embed insurance into daily life with your digital partners. All patterns supported with full digital operation.

À la carte

Tailor-make a solution via mix-and-match of components on the platform.